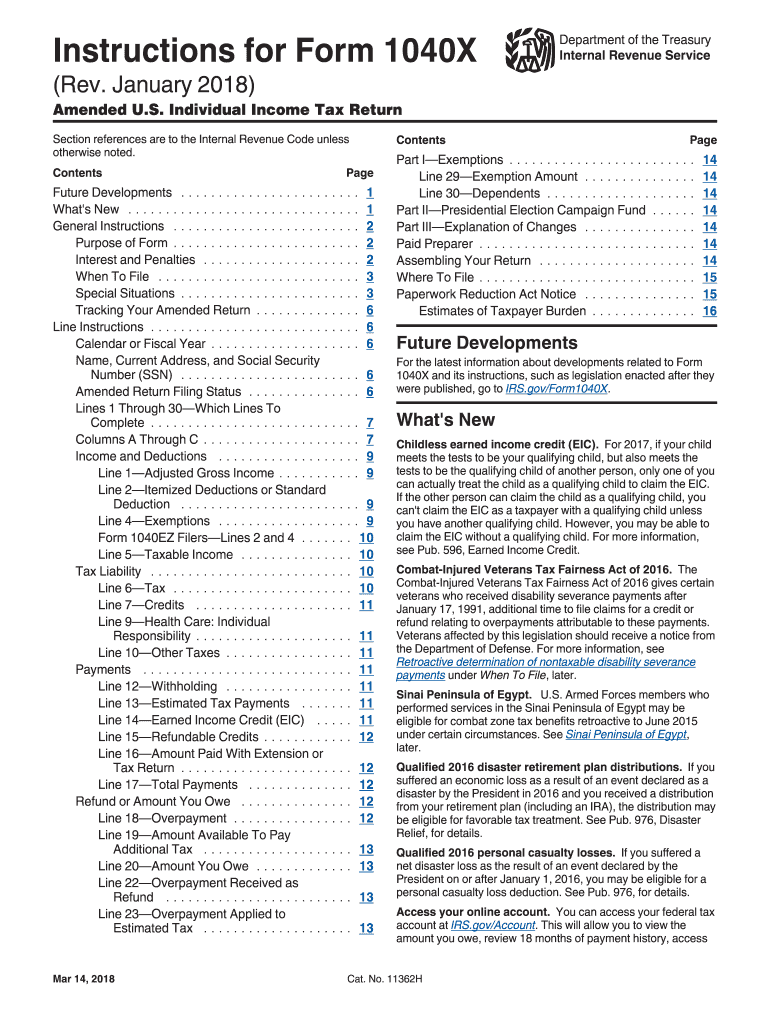

- #1040x free fillable forms 2016 for free#

- #1040x free fillable forms 2016 series#

- #1040x free fillable forms 2016 download#

Send the electronic document to the parties involved.Ĭompleting 2009 Fillable 1040x Form does not need to be confusing anymore.

#1040x free fillable forms 2016 download#

Download the completed template to your gadget by clicking Done.In case you need to change some information, the online editor as well as its wide range of instruments are available for you. Examine the form for misprints as well as other mistakes.Add the date and place your electronic autograph once you complete all other fields.Choose the fillable fields and include the necessary data.x x income in care of name (attorney, executor, personal representative, etc. Form IA 1040 requires you to list multiple forms of income, such as wages, interest, or alimony. Change amounts previously adjusted by the IRS. Make certain elections after the prescribed deadline (see Regulations sections 301.9100-1 through -3 for details).

#1040x free fillable forms 2016 for free#

#1040x free fillable forms 2016 series#

E-filing Forms - To efile forms, (except Form 4868) they must be attached to a 1040 series form (1040, 1040A or 1040EZ). A form limitation may keep you from completing or e-filing your return.Are you still looking for a fast and practical solution to complete 2009 Fillable 1040x Form at an affordable price? Our platform offers you an extensive variety of templates that are offered for submitting on the internet. Michigan state income tax Form MI-1040 must be postmarked by Apin order to avoid penalties and late fees. Gather your original return and all new documents. If you need to write in additional information on a form, other than the 1040 series, you may not be able to use this program to efile your tax return. If you need to write in additional information on a form, other than the 1040 series, you may not be able to use this program to efile your tax return.Į-filing Forms - To efile forms, (except Form 4868) they must be attached to a 1040 series form (1040, 1040A or 1040EZ).įorm Limitations - There may be Known Limitations of forms you plan to complete. Writing In Information - Your ability to "write in" additional information to explain an entry is generally limited to the 1040 forms and some of the more frequently submitted forms. If the spouse or dependents have an IP PIN, you cannot use this program to efile the return. Identity Protection PIN's (IP PIN) - This program only supports the entry of a Primary taxpayer's IP PIN. Individual Income Tax Transmittal for an IRS e-file Return, to mail that information, you will not be able to use this program to efile your return The "Attaching Statements" and "Write-in information" sections seem like they might apply to your situation.Īttaching Statements - If you need to add statements and you can't use Form 8453, U.S. Limitations of FreeFile are explained here, along with a list of forms that are available: Free internet filing and E-pay services are available for most Louisiana. If the information you need to submit an attachment for doesn't follow one of the options on that form, you will likely need to file a paper return or use a paid tax preparation service/application. withheld in 2016, you must file a return to claim a refund of the amount. This is helpful for form 8489, for example, where you need to list every transaction reported by your stock broker on a 1099-B. Depending on what you need to explain, you can submit your electronic return without the supplemental information and subsequently mail a Form 8453 with the additional information.

0 kommentar(er)

0 kommentar(er)